2025

Expansion to Germany and refined offering

In January 2025, we announced the establishment of operations in Germany during the second half of 2026. The German savings market is the largest in Europe and more than twice the size of the combined Nordic markets. With a growing number of savers in stocks and funds, this new market extends the potential for Nordnet’s continued growth.

To position ourselves as the top choice for customers with substantial savings, we presented a major update of our Private Banking offering with new features, a modernized design, and adjusted prices. The concept introduced a new customer categorization based on savings capital, linked to benefit packages and a clear status indicator. This launch marked the beginning of a broader initiative aimed at strengthening our position among high-net-worth customers, with the ambition of becoming the leading Private Banking provider in the Nordics.

We also took important steps to enhance our trading platform. To meet the growing demand from the more engaged and stock-oriented customers, we expanded our reach by opening nine new European markets for digital trading and introduced pre-market trading in US equities. In addition, we launched foreign currency accounts for ISK and endowment insurance in Sweden, as well as advanced order types such as algorithmic trading, giving customers access to more sophisticated tools for efficient execution across markets.

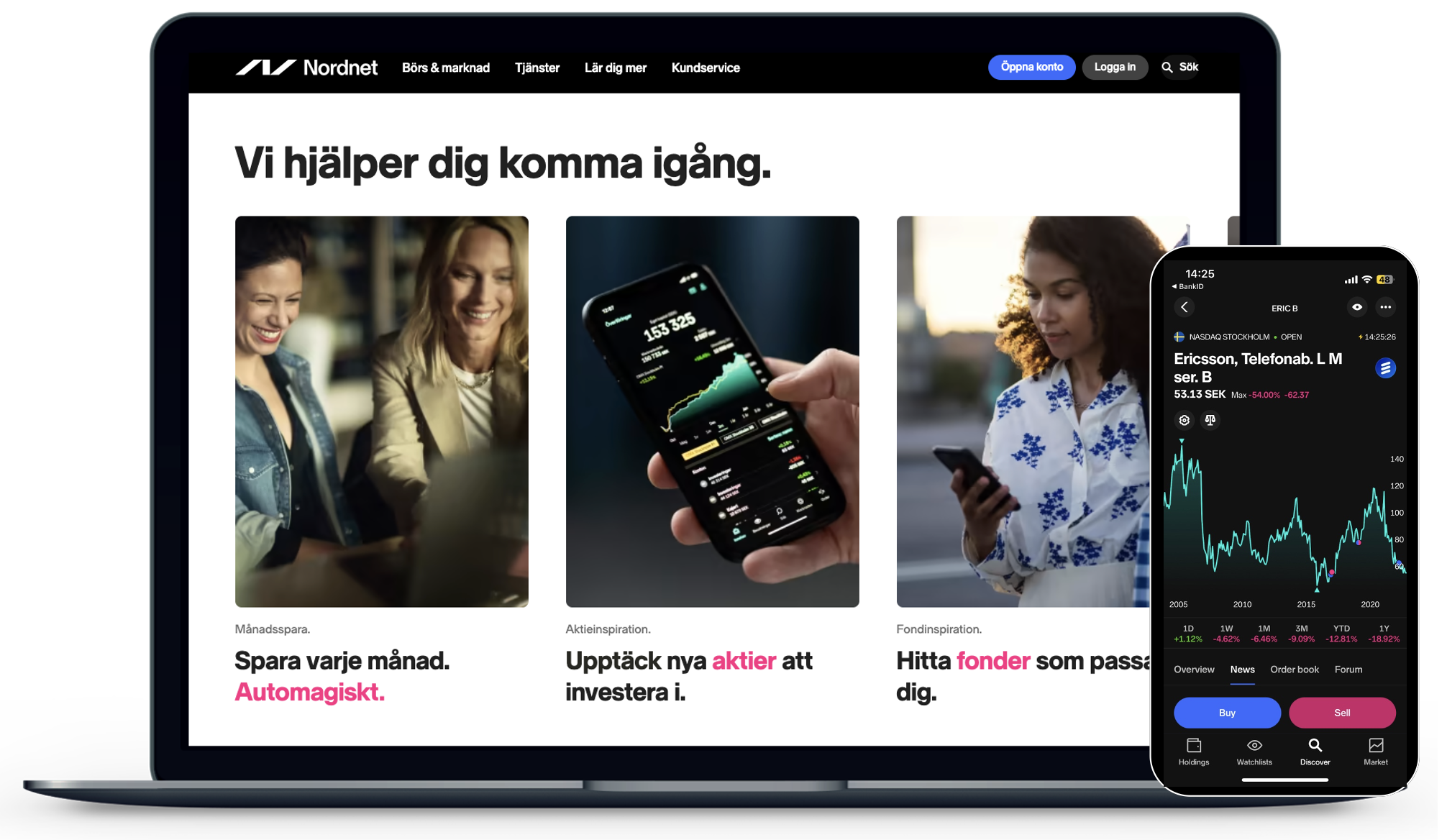

As a testament to our efforts to create a best-in-class user interface, we received the Red Dot award in 2025 - the second time in Nordnet's history. The prestigious award recognizes excellence in design, functionality, and user experience in our app. The app remains central to our platform, with the majority of customers trading and managing accounts via mobile.

2024

Full pension offering in Denmark and key data on our platform

The biggest launch of 2024 was the Danish pension product livrente, which significantly expanded Nordnet’s addressable market. With this addition, we realized our ambition of becoming a one-stop shop for savings across all our markets.

Nordnet closed the sale of the unsecured lending portfolio. The divestment was in line with our strategic focus, as unsecured lending had become an increasingly smaller part of our business and lacked a strong connection to our core operations. By completing this sale, we freed up capital and sharpened our focus on our core savings and investments business.

In order to further increase the usability of our platform as a tool for investors and savers alike, Nordnet became the first savings platform in the Nordics to provide analyst data from the internationally recognized company Factset. This partnership allows us to offer customers analyst recommendations and target prices for all companies on our platform covered by investment banks or research firms. We also launched a new brand concept focused on the joy of savings with the goal of driving brand awareness for Nordnet across the Nordics through major marketing campaigns.

2023

Focus on accessibility and innovation

In 2023, we focused on making savings even more accessible. In Finland, we launched a new endowment wrapper product that offers tax advantages for trading in shares and funds. We also entered into a collaboration with the tech company Quartr, becoming the first bank in the Nordics to provide customers access to report presentations and earnings calls from listed companies worldwide.

To increase accessibility and convenience, we partnered with Trustly to enable real-time money transfers from external banks to Nordnet accounts and introduced the new Freja login option, providing customers with more choice for accessing our website and app.

2022

Awards and important steps for Nordnet’s fund business

During 2022, we launched several new initiatives and reached key milestones. This was recognized when we were named “Bank of the Year” by the Swedish finance magazine Privata Affärer, garnering the highest overall rating from its readers. The jury highlighted our strong voice for savers in public debate and our ongoing product development.

To further widen our offering, Nordnet introduced a mortgage product in Norway, offering the market’s cheapest residential mortgages to private banking customers. We also enabled electronic trading on the London Stock Exchange, expanding our reach to eight international exchanges.

We launched our mutual fund company, Nordnet Fonder, with the goal of providing high-quality, cost-effective passive asset management focused on attractive asset classes for long-term investors. This allowed us to introduce our first allocation funds across all markets and take management of our five Nordic index funds in-house. As part of a broader savings initiative, we launched Nordnet One, a new digital tool that makes it easy for savers to start long-term savings and get inspiration for their fund choices.

2021

Expanded offering and focus on sustainability

The year 2021 was defined by the expansion of the product offerings. In Norway, we successfully launched the EPK personal pension account, allowing savers to consolidate their various occupational pensions into a single, easy-to-manage account. We also made it possible for our Danish customers to open an equity savings account, which provides more favorable tax terms for securities trading than a traditional share depository.

In addition, our mobile app was honored with the prestigious Red Dot Award in the “Brands & Communication” category for finance apps. The award recognizes outstanding user experience and highlights our focus on modern design and frequent updates.

In a move to enhance sustainable investing, Nordnet became the first mutual fund platform in the Nordics to include information on the EU’s new sustainability categories, Articles 8 and 9 (“light green” and “dark green”). This new feature allows savers to easily search and sort funds by these classifications when making investment decisions.

2019-2020

Innovation, strong results and comeback on the stock market

The high pace in innovation and strong focus in creating cutting edge financial products also characterized the years 2019-2020. During 2019, a new website was launched in all of Nordnet’s four markets. Several updates and improvements were made in the web and app with a focus on increased customer experience and stability. Four new international index funds under our own name and a number of digital tools to make it easier to invest more sustainably were launched. Nordnet was among others the first bank in the Nordics to introduce sustainability data and screeners for exchange-traded funds (ETFs) on its platform. At the turn of the year 2019-2020, the new account form “osakesäästötili” could begin to be used for trading in Finland, and Nordnet quickly took the lead with a market share of 75 percent. We were awarded as the “Bank of the year for small businesses” by Privata Affärer, as well as “Broker of the Year” by the Finnish shareholders’ organization (Suomen Osakesäästäjät) in 2019. In March 2020, we reached the milestone of one million customers, which meant that we doubled our customer base since 2016. In November 2020 Nordnet made a comeback as a listed company, this time on Nasdaq Stockholm’s large cap list.

2016-2018

High innovation speed and broader customer offering

During this period we passed several milestones and focused on broadening and improving our customer offering. In early 2016, Nordnet reached the milestone of half a million customers on a Nordic basis. We strengthened our loan offer and launched Sweden’s cheapest mortgage during the same year, addressed to Private Banking customers. In the beginning of 2017, Nordnet AB (publ) was delisted from Nasdaq Stockholm and the Öhman Group and Nordic Capital became new owners. The process of building the new Nordnet started and a number of product launches were introduced in the coming years, for example direct deposits via Swish, new app, stock lending program and digital advisory services. We were awarded for our high innovation speed and were named “Bank of the Year 2017” and “Savings Innovation of the Year 2018” by the Swedish financial magazine Privata Affärer. Before the turn of 2019, we announced that Nordnet acquires the Norwegian bank Netfonds, and create Norway’s leading digital bank for savings and investments.

2013-2015

Social investment network and fee-free superfunds

During this period, we took several steps towards making savings and investments even more accessible and attractive. We lowered and eliminated several fees, simplified the process of opening an account, and launched four Nordic funds with no fees at all. We acquired and launched the social investment network Shareville where our customers share their investments in real time and can look at other savers’ portfolios, and reached a milestone with 400,000 savers on our platform.

2009-2012

Nordic focus

Acting pioneers once again, we launched the first Nordic mobile app to offer the possibility to trade in shares and funds in 2010. We made the strategic decision to be a bank for Nordic savers, and therefore sold our businesses in Germany and Luxembourg. We grew further in the Nordics by acquiring the biggest online broker in Finland, eQ Bank, and the Swedish company Konsumentkredit. The acquisition of Konsumentkredit allowed us to step into a brand new business area – personal loans. We also started our blog, where we and our customers can share inspiration, experiences and facts about investments.

2004-2008

Pension

This is the period when we broadened our offer to include pension products – both private and occupational. The terms of our pension products were the best on the market, putting the customers’ interest first. We started our business in Finland and thanks to our acquisition of Stocknet-Aston Securities ASA, we also entered the German market. By this time, we had outgrown our old website. In 2007 we launched a new, user friendly site in each country.

2000-2003

Development

Nordnet AB (publ) was listed on the Stockholm Stock Exchange in 2000, and we received our banking license in 2002. We were developing quickly during these years, merging with our competitor Teletrade and establishing our businesses in Norway and Denmark. Our customers enjoyed several new features, such as a marketplace for hedge funds, a trading application (Wintrade) and a low-price investment platform (Aktiedirekt).

1996-1999

Pioneers

Nordnet was founded in 1996 as one of the first online brokers in the Nordics. During the next few years, there were many more ”firsts” to come. We were pioneers in offering real-time share prices, real-time trading in options and mini-futures, trading in American shares as well as trading in mutual funds with no trading fees. In 1999, we established Nordnet Luxembourg.