Sustainability.

Sustainability is at the core of our strategy

Sustainability is integrated into Nordnet’s overarching purpose to democratize savings and investments. As a digital savings platform, we can contribute to a positive societal development, primarily by helping our customers start saving and to shift capital towards sustainable investments. By offering tools for investing, increasing awareness about personal finances, acting for a better gender balance in savings, as well as making it easy to save sustainably, we promote socially beneficial objectives while simultaneously improving our long-term competitiveness.

Latest

We have published our Sustainability Report for 2024. We work in three focus areas - Democratizing Savings & Investments, Sustainable savings, and A Responsible and Sustainable Business. Read our sustainability report here.

During 2024, we joined the Science Based Targets Initiative (SBTi) and intend to ensure that our climate goals are scientifically based using SBTi's method in the coming year. We also signed the UN Global Compact, a global UN initiative for companies with the goal of incorporating sustainability-related principles. Read our sustainability strategy here.

Nordnet aims to simplify sustainable savings and investing. In order to gain greater focus on our work in this area, we are now beginning to present certain sustainability-related key figures in our interim reports; the proportion of fund capital invested in sustainable funds, the proportion of fund capital invested in dark green funds and the proportion of female customers. Read more and see the key figures in our latest interim report, here.

Our sustainability strategy

Sustainability is at the core of our strategy – to democratize savings and investments. Our sustainability work is closely tied to the general mission and work of Nordnet. Nordnet has three sustainability focus areas with goals linked to each area.

Nordnet’s strategic sustainability focus should be directed towards the areas in which we have the most credibility and the greatest opportunities to influence favorable development. This entails a focus on areas and topics in line with our overarching business strategy of democratizing savings.

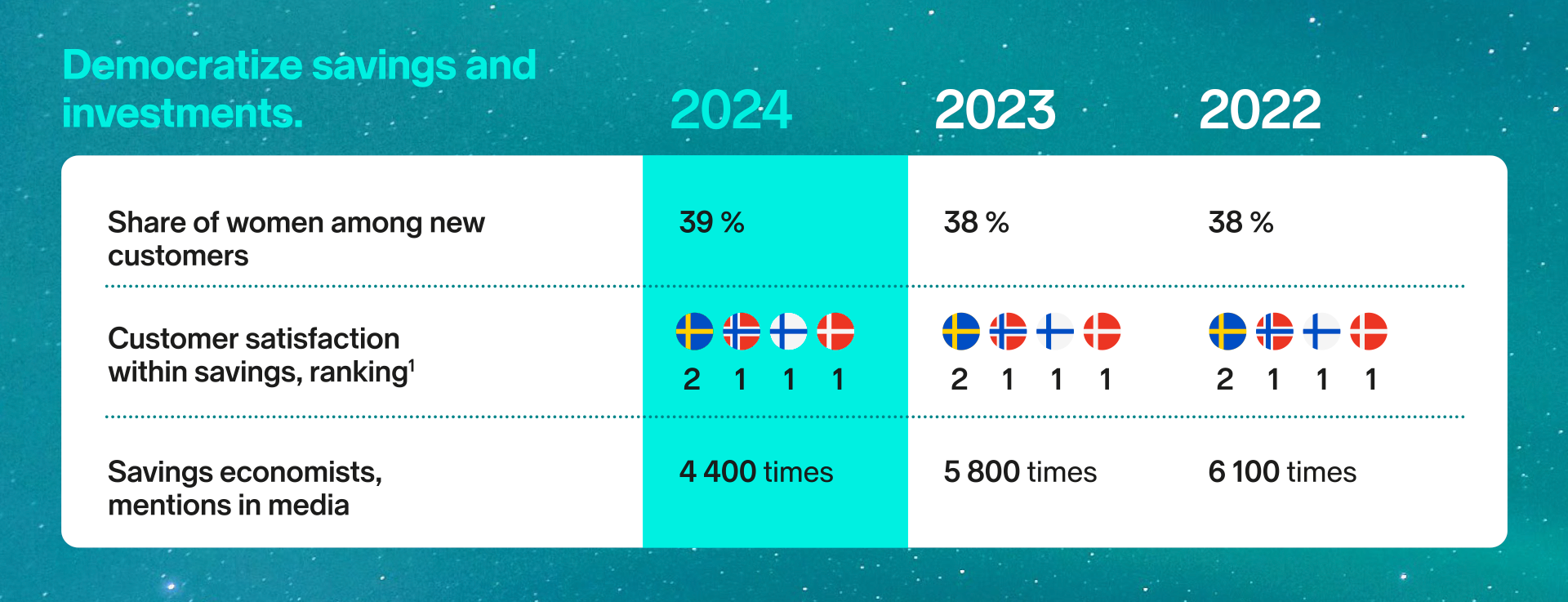

Democratizing savings and investments.

The overarching purpose of Nordnet’s business is to democratize savings and investments by offering private investors access to the same tools, information and services as professional investors. Increased accessibility and increased financial freedom have a positive impact on individuals, as well as on society.

Education in investment and personal finance.

Educating people around shares, funds and personal finance is a central part of our work to democratize savings and investments. Through internal and external channels, we seek to inspire and engage new and more experienced investors alike, as well as to enhance general awareness in savings and investments.

Advocacy in private financial matters.

Nordnet is active in the public debate on savings and investments in the markets where we conduct our operations. We are always on the side of the savers, working for the best interests of savers on matters involving shares, funds, pensions and private finances in general. The goal is to improve the savings market for private savers, and to be a clear voice in important matters for savers.

Digital and user-friendly tools.

Our objective is for Nordnet to be the natural choice for private savers in the Nordic region. To succeed with this, we must have the highest customer satisfaction in our industry in each market, which is enabled by a modern and user-friendly platform. Our customers should be able to find everything they need on Nordnet’s platform, and we work to continuously simplify and improve the customer experience.

Gender equality in savings and financial inclusion.

In order to fulfill our overall purpose of democratizing savings and investments, achieving equality is an important area in which Nordnet can make a difference. We educate, inspire and aspire to encourage more women to start saving in shares and funds and to take control of their financial future. In 2023, we launched Nordnet Female Network, which is an initiative to increase women’s savings and reduce the financial gap between women and men. The network aims to increase women’s financial freedom and to inspire, encourage and support female savers. The network is active in Sweden, Norway and Finland.

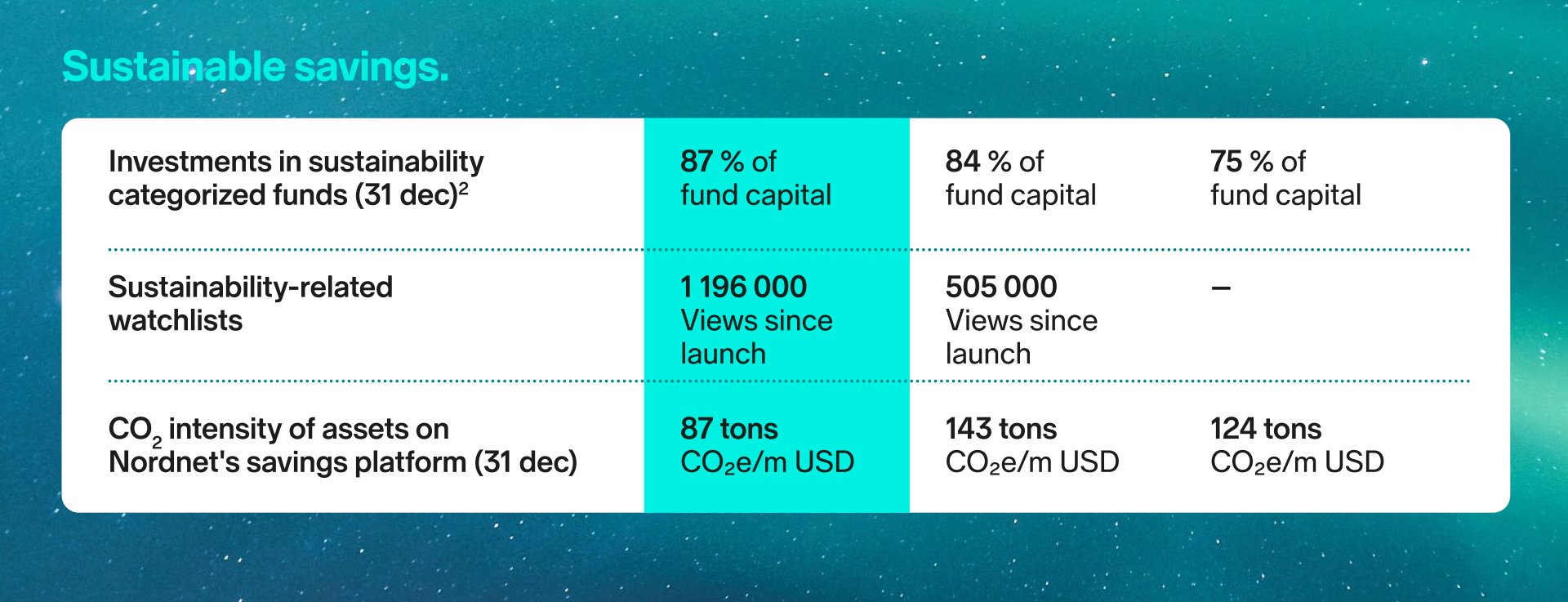

Sustainable savings.

Nordnet aims to become the leader in sustainable savings in the Nordic region. For savers interested in sustainability, Nordnet’s platform should be the first choice. Our strategy for achieving this is to offer a broad range of sustainable investment options. We shall also offer digital interfaces, data and tools to help our customers easily identify sustainable alternatives, as well as information and inspiration regarding sustainable investments.

A broad range of sustainable savings products.

To enable more people to save and invest sustainably, it is necessary for Nordnet to offer a broad range of sustainable savings products. Nordnet’s investment universe mainly includes shares, funds and ETFs, but also other types of investment instruments and savings products. The ambition is to offer a broad range of sustainable alternatives in all of the product categories we cover.

Tools for investing sustainably.

On Nordnet’s platform, features are provided to facilitate savers’ sustainable investments. It is in our DNA to develop digital and user-friendly tools that simplify life for our customers, which also includes functions for sustainable investments. Our objective is to make it simple for customers to save sustainably by building innovative features, as well as by providing a broad range of sustainability data.

Communication around sustainable investments.

The third sub-area within our strategy to facilitate customers’ sustainable savings, involves communications about sustainability. Nordnet seeks to inspire and to contribute knowledge in sustainable savings and investments and achieves this both by providing information in our interfaces and through our work in education and advocacy.

Climate impact of our customers’ investments.

Nordnet stands behind the Paris Agreement to limit global warming well below 2°C and striving to limit it to 1.5°C. In line with this ambition, Nordnet’s overarching target is for the CO2 footprint from savings capital on Nordnet’s platform to decrease in accordance with the Paris Agreement. The Board of Directors adopted the objective of reducing the CO2 footprint from the savings capital as the overarching objective within the strategic ambition “A sustainable business” which is a cornerstone of Nordnet’s strategy

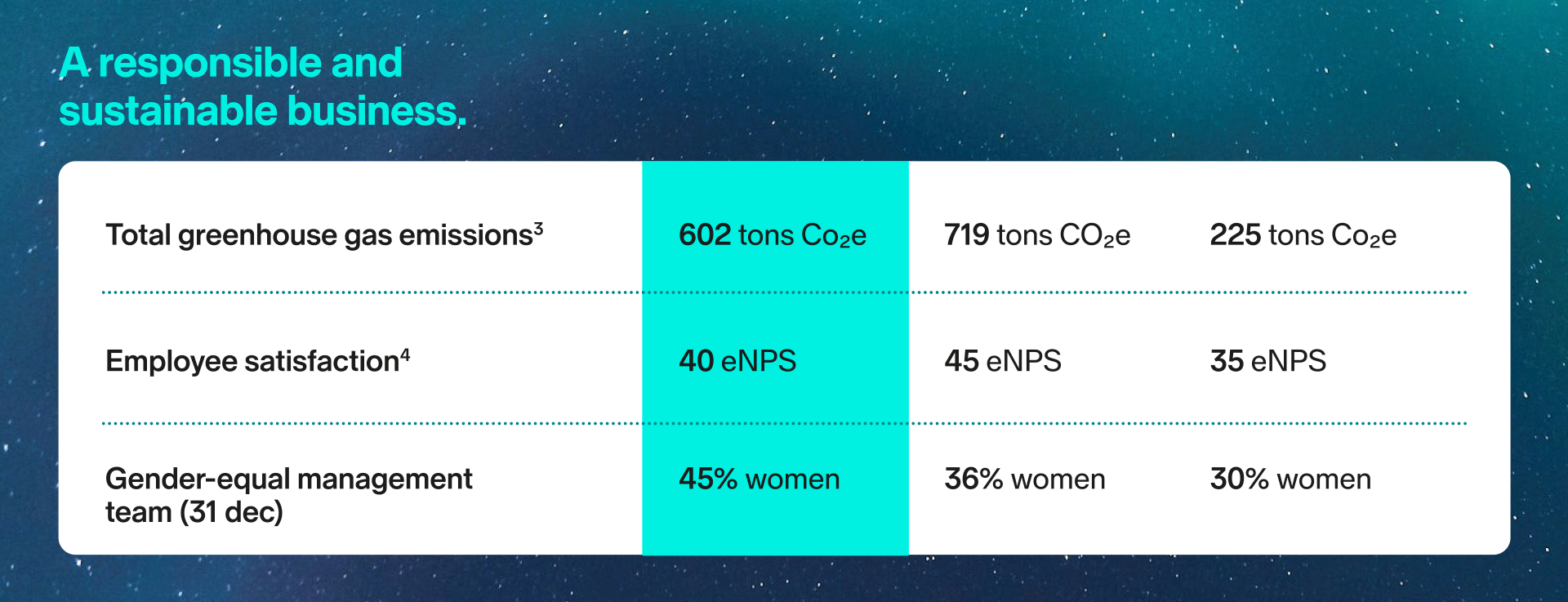

A responsible and sustainable business.

Nordnet conducts banking, securities, fund and insurance operations and it is important to always act ethically and responsibly. We also need to safeguard good governance and regulatory compliance, as well as working actively with controls and addressing risks. This means, among other things, that we must maintain good business ethics and a high level of awareness of regulatory compliance issues. Responsibility also means that we must limit our own environmental impact and ensure that Nordnet is an attractive workplace, achieved by both gender equality and diversity.

Business ethics and regulatory compliance.

Nordnet shall conduct responsible operations and to leave as positive an impression as possible in the markets in which we operate. Our guiding principles are transparency, superior ethical standards and benefit for savers in all parts of our offering.

Environmental and climate work at Nordnet and among suppliers.

Nordnet’s business model is digital, and we have no physical bank offices or similar. With a scalable digital platform and with automated and digital processes, we have limited direct impact on the environment. We nonetheless work extensively to limit the emissions we have and seek to limit our other environmental impacts and we climate-compensate our greenhouse gas emissions.

Employees.

Our employees are our most important asset and satisfied employees is the key to our success. To ensure employees are happy, we actively work to create an engaging workplace, that prioritizes health and well-being. We value the diversity of our employees as an opportunity that generates creativity and innovation, and fosters a committed and dynamic culture.

Better through diversity and gender equality.

For us, it is vital to have an equal workplace and to provide equal opportunities within the company. We consider an equal organization pervaded by diversity and an inclusive culture as an asset that is essential for innovation, creativity and productivity. The overarching target is for Nordnet to be a workplace characterized by equality and diversity. One example of how we are working to create a more equal fintech-industry is our career netwrok Power Women in Tech. Power Women in Tech was founded in 2018 and has around 2,200 members.

The Sustainable Development Goals

Agenda 2030 and the UN’s global goals are frameworks for sustainable development. Of the UN’s 17 global sustainability goals, we have selected the six goals we consider closest to our areas of focus, thus linking our own sustainability work to the global challenges we face

Goal 4:

It is important that everyone has access to knowledge on private finances. With our efforts in education and advocacy, we seek to contribute to UN global goal 4, Quality education.

Goal 5:

For us, it is important to develop a workplace characterized by both gender equality and diversity. We work actively to recruit more women to all decision-making levels, in line with UN global goal 5 Gender equality.

Goal 8:

Nordnet works to democratize savings and investments and give all private individuals in the Nordic region access to a user-friendly platform enabling them to take control of their finances, in line with goal 8, Decent work and economic growth.

Goal 10:

Promoting economic inclusion in society, in line with UN global goal 10, Reduced inequalities, goes hand in hand with our purpose of democratizing savings and investments. We want to inspire everyone, regardless of background, gender or age, to take control of their personal finances.

Goal 13:

By helping our customers to invest more sustainably, we can facilitate access to financing for companies fighting climate change and thus contribute to Goal 13 Climate action. We shall also work to decrease the emissions from our own operations and throughout the supply chain.

Goal 16:

By combating financial crime and corruption and by contributing to a safer society, Nordnet is able to influence UN global goal 16 Peace, justice and strong institutions.

Initiatives we support

PRI

Through our subsidiary Nordnet Fonder, we have signed the UN-backed initiative Principles for Responsible Investments (PRI). PRI is an initiative where financial actors work to implement different guidelines and principles within responsible investments. The aim is to promote responsible action in the finance sector and increase transparency and awareness of sustainability issues around the environment, social issues and corporate governance in the companies in which the financial actors invest.

Global Compact

We are a signatory of UN's Global Compact, a global initiative to incorporate sustainability-related principles into operations. The initiative is based on ten principles based on international conventions. The principles cover human rights, labor law, the environment, and actions against corruption.

Unga Aktiesparare

Nordnet is a proud partner of Unga Aktiesparare. Unga Aktiesparare is an independent, non-profit association that works to increase knowledge among Sweden's younger population around savings and investments. Through, among other things, events, a member magazine and lectures, they spread knowledge in personal finance to young people, a mission in line with our purpose to democratize savings and investments.

CDP

CDP is an independent, international non-profit organization that works for transparency and dialogue about companies' environmental impact and to make information available to investors. Starting in 2024, Nordnet participates in CDP.

Swesif

Nordnet is a member of Swesif, a network-oriented forum for organizations that work for, or with, sustainable investments in Sweden. Swesif aims to increase the knowledge and interest in sustainable investments among institutional capital owners and managers.

ECPAT

ECPAT is a non-profit organization that works against all types of sexual exploitation of children. The organization aims to motivate policymakers, authorities, and companies to combat the demand for sexual abuse of children. The members of ECPAT cooperate with the police with the aim of stopping the trade in child pornography where transactions are made through the financial system.

Science Based Targets Initiative (SBTi)

The SBTi is a partnership between CDP, the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF). To ensure that Nordnet’s efforts to achieve the Paris Agreement are in line with science, we have committed to the Science Based Targets Initiative (SBTi). Nordnet will consequently set net-zero targets in line with science within 24 months.

Transition plan

Nordnet stands behind the Paris Agreement and its goal of keeping global warming below 2 °C and striving to limit it to 1.5 °C. This is reflected both in our climate work within the framework of Nordnet's operations and the indirect impact resulting from the services we offer. As a digital savings platform, our main contribution to societal development is by facilitating the capital shift towards sustainable investments. Nordnet's strategy for working in line with the Paris Agreement is based on identifying how we can make a difference and where we have the greatest opportunity to influence. As part of that work, we have formulated this transition plan.

Climate change is one of the greatest challenges of our time. At the same time, it could also lead to opportunities if we can help our customers allocate capital to more sustainable investments. With our resource-efficient and digital way of working, we can help drive positive change. Our work should be based on our values of passion, transparency and simplicity, and our ambition to make it easy to save sustainably.

Our sustainability work must be characterised by long-term thinking and continuous improvement. This transition plan will be revised over time as methods and data are refined and as Nordnet's climate work develops.

Sustainability report and policies

Each year, we prepare a report in accordance with the Global Reporting Initiative (GRI), the world’s most widespread framework for sustainability reporting. Click here for our latest sustainability report.

Read more about sustainability work in accordance with SFDR (Sustanable Finance Disclosure Regulation) (in Swedish):

Hållbarhetsrelaterade upplysningar Nordnet Bank AB

Hållbarhetsrelaterade upplysningar Nordnet Pensionsförsäkring AB

Hållbarhetsrelaterade upplysningar Nordnet Livsforsikring AS

Hållbarhetsrelaterade upplysningar Nordnet Fonder AB

Information relating to our work on transparency and fundamental human rights and decent working conditions can be found in our Transparency Act Statement published below. The Statement is disclosed in accordance with the Norwegian Act relating to enterprises' transparency and work on fundamental human rights and decent working conditions (Transparency Act).

Redegjorelse etter apenhetsolven 2023 Nordnet Livsforsikring AS

Redegjorelse etter apenhetsolven 2024 Nordnet Livsforsikring AS

Redegjorelse etter apenhetsloven 2023 Nordnet Bank NUF

Redegjorelse etter apenhetsloven 2024 Nordnet Bank NUF